SUSTAINABILITY ![]() Energy and climate change

Energy and climate change

Golden Mine Projects is fully aware of the seriousness of climate-related risks and the societal expectation for companies to contribute to carbon emissions reduction. We also recognize the valuable opportunities that lie in a low-carbon future. The impacts of climate change are becoming increasingly evident, mainly due to:

Our stakeholders, especially investors, not only expect us to take tangible actions to curb carbon emissions but also demand comprehensive reporting on the effects of climate change on our operations.

In response, Golden Mine Projects unveiled a comprehensive set of 2030 targets for its most significant environmental, social, and governance (ESG) priorities in December 2021 (p62). These goals were highlighted by our commitment to address our impact on global warming, with three key targets:

The estimated investment in decarbonizing Golden Mine Projects is around US$1.2 billion until 2030. Additional details regarding costs and savings will be provided upon the completion of detailed studies for all relevant projects. It is anticipated that a significant portion of the capital will be funded through power purchasing agreements (PPAs) with independent power producers (IPPs). All projects are expected to yield positive net present value (NPV).

To date, we have already invested nearly US$400 million in energy projects, primarily at our Australian mines, with a significant portion financed through PPAs.

Failure to implement climate adaptation measures ranks among the top 10 Group risks for Golden Mine Projects. We evaluate our susceptibility to climate change at least every five years and adapt our strategies and programs across the entire Group accordingly. We recently concluded a review in 2021 and disclosed pertinent details in our 2021 CCR.

Golden Mine Projects heavily relies on consistent energy supplies. In 2021, our total energy expenditure represented 18% of our overall Group operating costs.

We have instituted an Energy and Carbon Management Strategy to address our primary energy concerns, including supply security, cost-effective electricity, reduced energy consumption, and the mitigation of our energy consumption's impact on the climate. This strategy is reinforced by operational plans and targets that align with the global ISO 50001 energy management standard. Our Cerro Corona, Damang, and Tarkwa mines have already received ISO 50001 certification. We aim to have all our operations certified by the end of 2023.

GROUP ENERGY CONSUMPTION

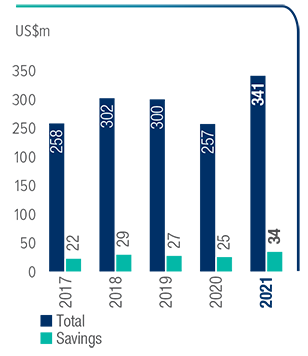

GROUP ENERGY SPEND AND SAVINGS1

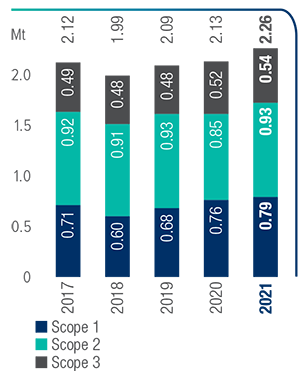

GROUP SCOPE 1 – 3 CO2e EMISSIONS2

The primary actions to meet our energy goals include:

While energy efficiency initiatives offer dual benefits of improved energy productivity and reduced carbon footprint, several of our efforts significantly reduce our carbon footprint without necessarily decreasing our energy usage. For instance, we're transitioning from diesel to gas or renewable sources of fuel. Our commitment to energy efficiency continues, with a focus on:

To ensure reliable, cost-effective, and decarbonized energy sources, we have begun integrating renewable energy into our energy supply mix. Our Australian mines, Agnew and Granny Smith, already operate renewable micro-grids and storage solutions. All our mines are actively exploring renewables, including battery-electric or low-carbon vehicles and increasing the use of renewable energy.

In 2021, 4.3% of our electricity came from renewable sources (12.5% including hydroelectricity at Cerro Corona). This figure is projected to rise to 15% (22% including hydro) by 2025, with renewables being adopted at St Ives, South Deep, Gruyere, and Salares Norte.

Most of our renewable projects are managed by independent power producers (IPPs), who recoup their investments through long-term supply agreements with our mines. Funding from Golden Mine Projects mainly comes from operational cash flows.

Our goal is for renewables to constitute approximately 70% of our electricity mix by 2030, increasing to 100% by 2050. Additional emissions savings will come from further energy efficiency initiatives and replacing our diesel-powered fleet with zero-emission vehicles. We're actively piloting these vehicles at various mines and collaborating with ICMM peers to accelerate the deployment of safer and cleaner vehicles.

In Australia, we're partnering with other mining companies in the Electric Mine Consortium to explore emission reduction options at mining sites.

Agnew, our flagship renewables mine, is one of the world's first gold mines to generate over half its electricity from renewables like wind and solar. In 2021, Agnew averaged 57% renewable electricity (up to 85% in favorable weather conditions) and reduced net Scope 1 and 2 carbon emissions by 42%. We're exploring ways to further increase this percentage by addressing gas engine limitations, expanding renewable energy storage, and installing more solar panels.

Granny Smith operates a hybrid storage system consisting of 8MW on-site solar, 2MW battery power systems, and a gas power plant, providing 10% of its electricity from renewables. Progress is underway on Gruyere's 12MW solar plant, with commissioning slated for Q2 2022.

At St Ives, we're conducting a feasibility study to identify alternative power sources when the existing agreement expires in 2024. Our aim is to achieve 75% to 85% renewable energy through solar and wind microgrids and other solutions.

In 2021, 10% of the region's electricity needs were met through renewables, a significant increase from 8% in 2020. This percentage is set to rise substantially in the coming years. Our investment in renewables was a major factor in the region's 2021 carbon emissions savings of 90kt CO2e.

South Africa

The South Deep solar project is in progress and is scheduled for commissioning in Q3 2022. South Deep has received preliminary approval to increase the solar plant's capacity from 40MW to 50MW, resulting in a cost increase from R660 million (US$42 million) to R715 million (US$46 million).

The solar plant is expected to provide approximately 24% of South Deep's electricity needs and could save the mine an estimated R125 million (US$8 million) annually, depending on Eskom's tariff rates. Estimated annual emission reductions are 110kt CO2e. The mine is also exploring wind power and battery storage.

Chile

We're developing a 26MW hybrid solar and thermal power solution for the Salares Norte project . Diesel generators will provide 16MW, becoming operational when production starts in early 2023. The solar plant will add 10MW in Q1 2024, saving the mine over US$7 million in energy costs over the first decade and US$1 million in carbon tax offsets.

In 2021, our energy spending increased by 25% to US$341 million (compared to US$257 million in 2020), mainly due to higher oil prices.

Total energy expenditure, which combines electricity and fuel spending, accounted for 18% of our total operating costs in 2021, up from 16% in 2020. This represents 14% of all-in sustaining costs (AISC), amounting to US$139 per ounce.

During 2021, we realized a net gain of US$21 million on oil price hedges (compared to a US$15 million loss in 2020) as international oil prices surged. These hedges, at our Ghanaian and Australian operations, remain in place until the end of 2022.

Total energy consumption increased by 6% to 13.9PJ, driven primarily by a 10% increase in mined tonnes. The energy mix comprises 51% haulage diesel, 48% electricity, and less than 1% from other fuels. Energy intensity remained relatively stable at 5.66GJ per ounce.

During 2021, we invested US$3 million in energy and emission reduction initiatives, resulting in energy savings of 1.21PJ in 2021 (compared to 1.09PJ in 2020) and long-term cost savings of US$34 million, equivalent to US$14 per ounce. Since launching our Energy and Carbon Management Strategy in 2017, we have achieved cumulative energy savings of 3.3PJ, yielding combined cost savings of approximately US$140 million.

Emissions Performance

Our carbon emissions closely align with our energy consumption trends. In 2021, our total Scope 1 and 2 CO2e emissions amounted to 1.71 million tonnes, a 7% increase from 1.61 million tonnes in 2020, despite a 10% increase in tonnes mined. Emission intensity increased slightly to 0.70 tonnes CO2e per ounce in 2021 from 0.69 tonnes CO2e per ounce in 2020. Emissions reductions from savings initiatives totaled 306kt CO2e in 2021 (compared to 253kt CO2e in 2020), surpassing the targeted 287kt CO2e reduction.